<intro>As customer expectations rise and competition increases (between both established players and new entrants) Insurers are looking for opportunities to level-up customer experience to drive profitability and growth through acquisition, resolution and retention.<intro>

Often a top priority for Marketing or Customer Services, opportunities to improve customer experience exist across almost all departments, from Claims and Underwriting to Technology and Operations.

This article explores some of those areas where disruption and innovation can drive exceptional customer experiences.

Digitisation of Customer Interaction

In 2020 the entire world has experienced a wholesale shift to digital channels. Customers are increasingly transacting online, with high service expectations based on daily interactions with vendors in and outside of work. Think Amazon, Monzo and Zoom. The Covid-19 lockdowns have reinforced the need for all business transactions to be simpler, faster and digitally-enabled.

In this new digital era, ease and immediacy, are key ingredients for a great customer experience.

The complex nature of the insurance business means that customer interactions are often varied and carriers distribute certain insurance products in direct channels but also rely heavily on intermediary agent or broker relationships to reach the end-customer.

In the personal lines space, Lemonade has stolen the insurtech limelight this year with a blockbuster IPO that’s brought AI to the forefront of insurance innovation. Centred around a chat-bot interaction that uses natural language processing (NLP) to read and respond to customers, Lemonade is an insurance carrier that provides lightning-fast underwriting and claims resolution. It appeals to a younger tech-savvy demographic and currently ranks 4.9 out of 5 on the Apple Store.

Similarly, Ping An has set new standards for what’s possible with digital innovation for the insurance sector. In the same way Western tech giants like Facebook now look Eastwards to WeChat for inspiration on messaging products, global insurers look to Ping An for examples of how to harness AI, NLP, Cloud, and IoT technologies to drive differentiated experiences (Ping An has invested $7bn in R&D). An example customer journey for a Ping An motor insurance consumer consists of an immediate underwriting decision via an AI assistant (on mobile), automatic claims resolution if you take sufficient pictures of vehicle damage in the event of an accident and enriched IoT data from your wearable. Ping An is often voted as the best insurance provider in Asia.

In the UK, insurtechs like Zego are providing usage-based insurance (UBI) products for car drivers and Flock provides pay-as-you-fly insurance for drone pilots. Essentially, on-demand consumption models that appeal now more than ever, in light of the Covid-19 environment.

These technology-enabled customer experiences are fast, simple and intelligent.

Similar experiences are now expected across the entire insurance value chain. From personal lines, right through to brokers and reinsurers dealing with commercial and specialty lines.

Traditional Insurers & Brokers

The example of Lemonade and others paint an exciting picture of the insurtech landscape. Startups have brought new customer-centric thinking to the table by focusing on price, accessibility and engagement. This focus has allowed cloud-first, mobile-ready insurers and MGAs, to double down on P&C lines where the processes are simpler and innovation is singularly focused on customer engagement. There’s no critical dependency on “core systems” or processes to execute.

However, the vast majority of insurance premium today is still dominated by incumbent insurers and traditional insurance relationships. Many of whom run on legacy systems and have a high dependency on knowledge workers executing manual processes (Aon & Willis merger creates the world’s biggest broker). The pandemic has amplified the pressure on insurers to innovate as they settle claims, write new products and ensure business continuity for the millions of customers affected by the crisis. Mckinsey recently observed that insurers’ valuations have decreased and reliance on offshore operations has caused significant disruptions in customer service.

In response, insurers can seize the moment and embed advanced analytics, NLP, image recognition and automation across the organisation to increase process efficiencies, scale response times and reduce cost.

One huge advantage for incumbent insurers is access to data. Most insurers have vast amounts of data scattered across the organisation in their product lines and channels. Ranging from communications data (calls, emails, chats) in the broker-to-underwriter channel, right through to claims descriptions and paper contracts. Until recently, this information remained unstructured, untapped and unusable by downstream IT systems without a human in the loop to hand off processes at each stage in the workflow.

But right now, innovators like Hiscox are transforming the client experience by bringing artificial intelligence into every conversation. Traditional interaction models in the broker-underwriter channel are being digitised at scale, where NLP is used to read, route and action unstructured email-based processes. Similarly, unstructured claims descriptions are being analysed to identify trends, root-causes and fraud.

Deploying Communications Mining at Hiscox has “completely shifted our collective mindset on what productivity looks like. People used to think it was defined by how many tasks they completed in a day. Now, they see it as how much value they add in a day.” Sarah Leach, Head of Broker Operations, Hiscox.

Similar examples of insurance innovation can be found in Hastings Mutual pursuing Hyper Automation (which Gartner has identified as No.1 strategic IT trend for 2020) to augment the productivity of the core back office operations. Whilst Zurich have realised 49,133 hours saved by robot processing.

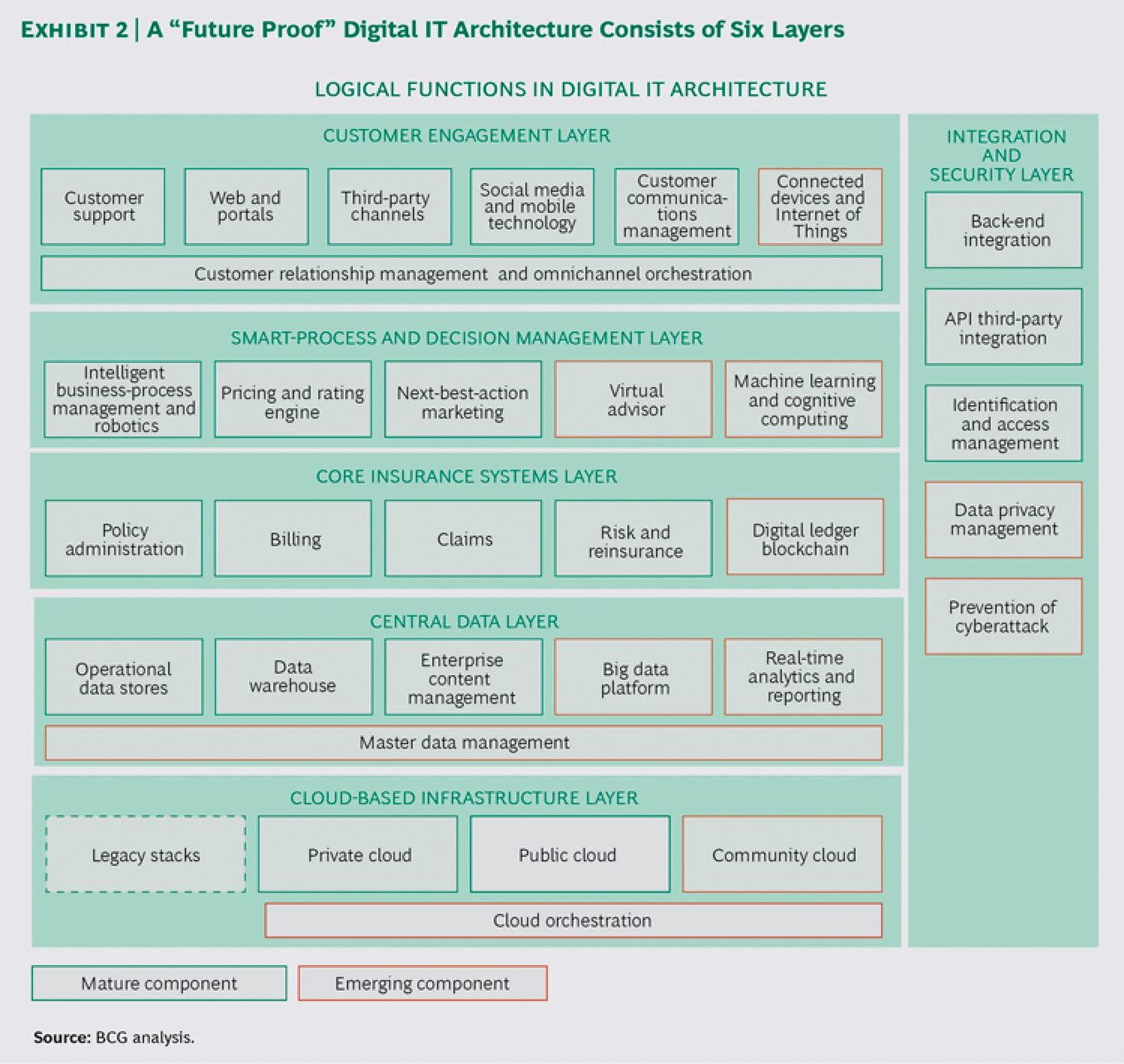

By integrating AI with automation tools, Insurers are able to introduce dynamic routing of customer requests and digitise key insurance lifecycle events such as claims, in term adjustments and submissions. At the Gartner Symposium Keynote October 19th 2020, it was stated that “by 2024, 25% of traditional large enterprise CIO’s will be held accountable for digital business operational results, effectively becoming COO by proxy.” So what we are witnessing is the emergence of ‘smart operations’ at the core of traditional incumbents. BCG sketched a target IT architecture below that many organisations can emulate.

Personalisation

In the same way Amazon and Netflix provide customised offerings to suit individual tastes, Insurance Customers’ expectations are shifting towards more bespoke offerings based on their behavior and activity, offering more transparency around their policies.

IoT powered fitness trackers and wearables such as FitBits, Apple Watches and Oura Rings are enabling life insurers to offer premiums based on activity trackers, mindfulness and diet information shared by customers. In 2019 Beam raised a $55 million Series D (total raised $90M) to further fund their connected toothbrush that lowers dental premiums by monitoring activity and encouraging preventive care.

Vitality is creating content, collecting data and building online communities centered around Fitness, Health and Mindfulness. During Covid-19, this has allowed traditional life insurers to provide policies without the need for an in-person underwriting examination by leveraging internal and external data sources.

What we are seeing in 2020 is a vast digital transformation event where both insurtechs and established titans are harnessing new technologies like AI to deliver high-touch experiences, proactive decisioning and frictionless interactions.

The insurance market is quickly becoming an ecosystem of intelligent players that harness tools and api connectivity to provide 360 degree views of customers that will drive customer lifetime value.

It’s abundantly clear that business with digitally-focused propositions, digitally-enabled sales and intelligent operations will outperform the competition.

According to recent reports from both Allianz Global and Swiss Re the Insurance industry is set to recover to pre COVID-19 crisis levels in 2021.

In pursuit of recovery and growth, Insurance companies must prioritise customer experience, improving through front end interactions and back office processes.